Meet Alex, a seasoned trader at UBS in Zurich, executing high-stakes deals on a volatile market day. As he inputs a complex derivative trade, an subtle anomaly—a mismatched data pattern—flashes on his screen, halted instantly by an AI alert. What could have spiraled into a multimillion-dollar error is caught early, allowing Alex to correct it seamlessly and close the day profitably, all thanks to UBS’s vigilant AI systems monitoring in real-time.

The challenge

In high-frequency trading environments, operational anomalies like data inconsistencies, unauthorized trades, or system glitches can evade manual checks, leading to massive financial losses, regulatory fines, and reputational damage—as seen in UBS’s past $2.3 billion rogue trading scandal in 2011. With billions in daily transactions, detecting these risks in real-time is critical yet challenging due to data volume and complexity.

High-level solution

UBS deploys AI-automated control testing across its trading platforms, drawing inspiration from Tesla’s real-time vehicle diagnostics that continuously monitor sensors for anomalies and enable proactive fixes. This AI-driven approach scans trading data for irregularities, ensuring early detection and mitigation of operational risks to maintain compliance and stability.

Three specific highlights

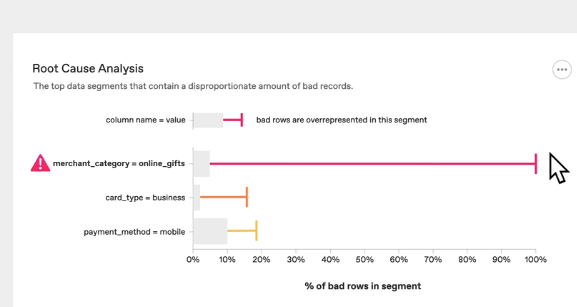

- Anomalo AI for Data Monitoring: UBS integrates Anomalo’s AI platform to automate anomaly detection in trading data, scanning vast datasets for irregularities like inconsistent patterns or outliers, reducing manual reviews by up to 90% and flagging issues before they impact trades.

- Pattern Recognition Models: Using custom AI models developed in-house, UBS applies machine learning for real-time pattern recognition across trading platforms, identifying anomalies in transaction flows similar to Tesla’s telemetry analysis, and integrating with compliance systems for automated alerts.

- Continuous Risk Scoring with ML: UBS employs machine learning tools for ongoing risk scoring and anomaly detection in operational processes, leveraging platforms like those in their AI strategy to predict defaults or irregularities, ensuring 24/7 vigilance akin to Tesla’s over-the-air diagnostics.

What is in it for me?

UBS’s Tesla-inspired AI controls provide a model for financial firms and industries like manufacturing or healthcare to enhance risk management. By adopting automated anomaly detection, organizations can minimize losses, boost efficiency, and foster a culture of proactive resilience in volatile environments.