Sarah, a single mom and small business owner, is juggling a hectic morning when she logs into the Capital One mobile app to pay her suppliers. As she hits “confirm” on a critical transfer, the app stutters briefly but recovers instantly. Unseen by Sarah, this was no glitch—it was a deliberate chaos test ensuring the app stays reliable under pressure, saving her from a costly delay and keeping her business running smoothly.

The problem

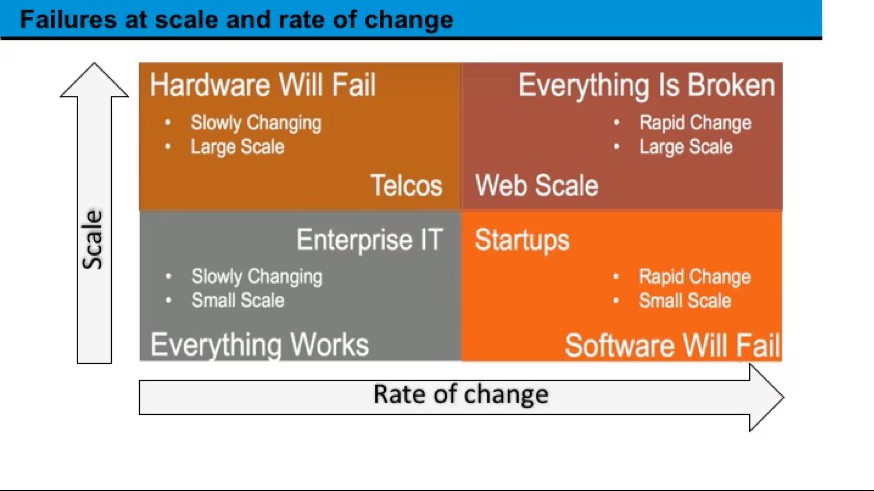

Digital banking demands near-perfect uptime, but unpredictable disruptions like server outages, network failures, or cyberattacks threaten customer trust and regulatory compliance. For Capital One, serving millions via cloud-based apps, even seconds of downtime can disrupt transactions, erode confidence, and invite scrutiny under standards like DORA and other risk frameworks.

High-level solution

Capital One employs chaos engineering, deliberately injecting controlled failures into production systems to test and refine disruption tolerance levels. By integrating data analytics, they align these tolerances with customer impact metrics, ensuring their banking apps remain resilient and compliant with operational risk requirements.

Three specific highlights

- Chaos Monkey in Production: Capital One uses Netflix’s Chaos Monkey tool to simulate network and server failures in live AWS environments, measuring recovery times to set precise tolerance levels (e.g., sub-second recovery for app transactions), ensuring no customer impact.

- GitOps-Integrated Chaos Testing: Their chaos experiments are embedded in GitOps pipelines using tools like ArgoCD, automating failure injections and enabling continuous tolerance reviews, reducing manual errors and enhancing app stability for 70 million+ users.

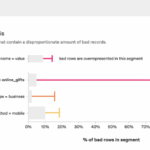

- Snowflake-Powered Analytics: By leveraging Snowflake’s data platform, Capital One analyzes transaction volumes and user behavior during simulated outages, refining tolerances to prioritize customer-facing services, like ensuring 99.99% uptime for mobile banking.

What is in it for me?

Capital One’s approach offers a blueprint for financial institutions and beyond to proactively strengthen resilience. By adopting chaos engineering, firms can reduce downtime costs, meet regulatory demands like CPS 230, and build customer trust in an always-on digital world.

Reference

https://www.capitalone.com/tech/software-engineering/continuous-chaos-introducing-chaos-engineering-into-devops-practices/